A branch is a form of business preferred by foreign entrepreneurs who want to enter the Maltese market in order to provide goods and services. A Maltese branch is not considered a legal entity, but it must be registered with the Maltese Registrar of Companies. The registration must be performed in a month, at most, after it is incorporated, but for more details and complete support, we recommend you get in touch with our company formation specialists in Malta.

| Quick Facts | |

|---|---|

| Applicable legislation |

For foreign countries |

|

Best used for |

Financial, banking, insurance activities |

|

Minimum share capital |

No |

| Time frame for the incorporation (approx.) |

Approx. 5 weeks |

| Management |

Local |

| Legal representative required |

Yes |

| Local bank account |

Yes |

| Independence from the parent company | No |

| Liability of the parent company | Yes |

| Corporate tax rate | 35% |

| Possibility of hiring local staff | Yes |

| Registration | The branch must be registered with the Malta Business Registry. |

|

Name |

The branch's name must match the foreign company's name. |

|

Business activities |

The branch can engage in the activities of the parent company. |

| Reporting | Annual financial statements and other reports are required. |

| Taxation |

The branch is subject to corporate income tax in Malta. |

| Accounting standards |

Prepare financial statements according to International Financial Reporting Standards (IFRS). |

| Shareholder approval |

The parent company's approval is needed to establish a branch in Malta. |

| Duration |

The branch continues as long as the parent company exists. |

| Legal compliance |

Comply with local laws, regulations, and licensing requirements for establishing a branch in Malta. |

| Intellectual property | Ensure proper protection for trademarks, patents, etc. after setting up a branch in Malta. |

| Branch address |

The branch needs a physical address in Malta. |

What are the requirements for opening a branch in Malta in 2024?

International companies can easily establish branches in Malta in 2024, following and respecting the appropriate legal framework. Below you can find important information about branches and incorporation in Malta:

- The actions and responsibilities of a branch in Malta are taken by the foreign parent-company, alongside the capital and assets.

- No minimum capital is required upon registration of a branch.

- Branches established in Malta usually pay the same income tax as the local companies, however, in most cases, tax facilities are granted.

- The Registrar of Companies in Malta receives the necessary documents for opening a branch in Malta.

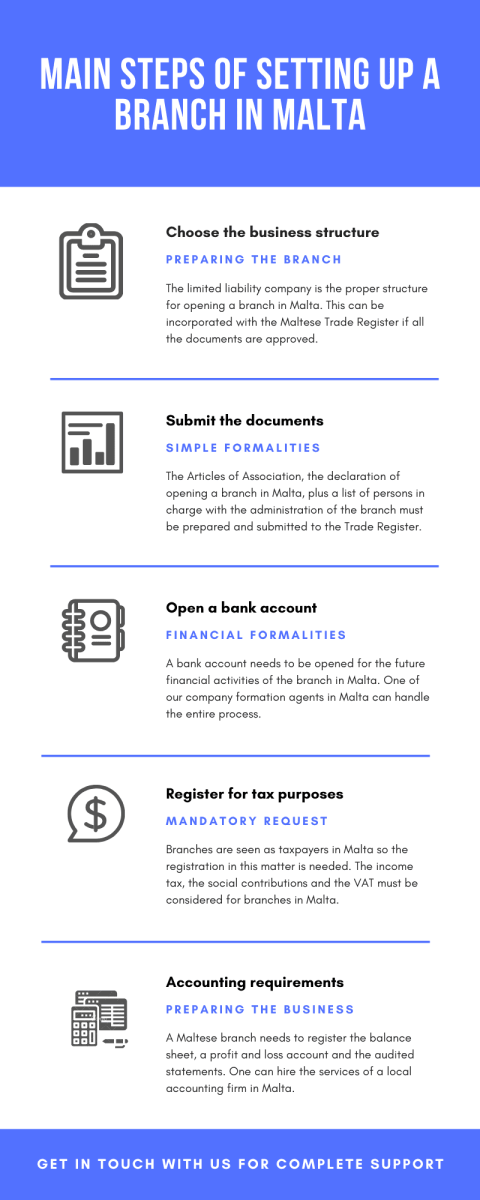

Maltese branches activate under the rules of limited liability companies, the proper business structure chosen for most of the business operations in this country. The formalities involved can be completely explained by our team of company formation representatives in Malta to overseas entrepreneurs. If you would like to benefit from complete support for opening a branch in Malta in 2024, please discuss with our specialists.

What are the advantages of a branch in Malta?

The advantages of owning a branch in Malta are numerous: lower incorporation costs compared to the subsidiary, no withholding taxes on dividends or interest and royalties as well as the benefits for income tax if the foreign company’s country has signed a double tax treaty with Malta, no minimum share capital requirements, the possibility to refund the taxes etc. Malta has entered into around 70 agreements for the avoidance of double taxation with various countries, providing a protective measure for businesses against being taxed twice. This makes the country an appealing destination for foreign investors looking to establish their companies. If you are interested in knowing if your country of origin has signed a double-tax treaty with Malta, our lawyers can offer you information in this regard.

Additionally, there is higher control for the parent company meaning that many actions of the branch must receive specific approvals from that company. The foreign investors who want to open a branch and also immigrate to Malta or other European countries, such as France, are recommended to get in touch with our local partners specialized in immigration who will help them with the legal issues.

Documents for opening a branch in Malta in 2024

Various articles of the Companies Act provide all the necessary regulations that a branch must follow in order to be registered with the Registrar of Companies and start its business activities. The documents and information about the parent company that must be deposited are:

- the authentic copies of the formation deeds, articles or memorandum of association,

- the form of company,

- the name and address of the registrar where the company is registered,

- a list of the persons in charge with the administration of the foreign company.

The Articles of Association must comprise the name of the branch and its address, the activities which will be performed by the branch, the name and addresses of the branch’s representatives who can be a natural person with residency in Malta. If you need help, our Maltese company formation agents will offer business consulting services for those who want to open a branch in Malta in 2024. Here is a video presentation that explains more:

The fact that Malta has signed over 65 double tax treaties to avoid double taxation and being considered the gateway to Europe makes the establishment of a branch extremely advantageous for foreign entrepreneurs.

Other requirements for Maltese branches

The foreign company must register also the balance sheet of the company, a profit and loss account and the audited statements. Any changes that arise in the foreign company’s Articles of Association or memorandum, as well as changes regarding the officers of the company or the branch’s authorized representative need to be submitted to the Registry of Companies in Malta. As it is known, the branch needs to perform the same activities as the parent company on the Maltese territory.

The Maltese rules for submitting the annual financial statements as well as the taxation principles in the country must be considered at the time the branch is incorporated in Malta. In case of company liquidation in Malta, the branch can be dissolved as any other type of company in the country, mentioning that this decision needs to be submitted to the Registrar one month before it starts.

Office facilities for branches in Malta

Traditional offices and virtual offices are at the disposal of entrepreneurs wanting to establish branches in Malta. The main difference refers to the costs involved for each type of office. For instance, those wanting virtual office packages in Malta will pay only a fraction of costs of a traditional office. A notable business address, a virtual assistant, mail collection and forwarding, a private phone number and extra usage of meeting rooms are among the facilities comprised by a virtual office package in Malta. Do not hesitate to get in touch with our company formation agents in Malta and find out more about how you can purchase virtual office packages or about how you can register a company in Malta.

Branches vs. subsidiaries in Malta

Foreign corporations have two major structures available for registration in Malta: a branch or a subsidiary, depending on their business needs. In comparison, a branch is partially independent and it is an extension of the parent company. As for a subsidiary in Malta, this is an independent legal entity which can be formed under specific conditions: a minimum share capital of EUR 1,165, at least two shareholders and a representative in Malta.

We mention that one of our consultants can act on your behalf and represent your business interests and the Maltese company, with a power of attorney. In matters of taxation, a branch needs to be registered only for VAT purposes, while a subsidiary must register for all tax purposes and submit the annual financial statements. It is important to know that the incomes of branches in Malta are taxes only in Malta, while subsidiaries are taxed on the global income. Specific tax exemptions are applicable to branches and subsidiaries, if mentioned by the double taxation treaties signed by Malta with countries worldwide.

Overseas investors are the ones who can decide on the type of business structure that suits most to their needs, whether a branch or a subsidiary, and in most cases, the pros and cons of each structure will weigh much in making a decision. In any case, you may request our advice and support if you would like to establish a branch or a subsidiary in Malta in 2024.

Accounting requirements for branches in Malta

Just like any other type of company, branches in Malta need to be registered for VAT and other tax purposes in this country. Submitting the annual financial statements is needed for branches in Malta. We remind that you can get in touch with our consultants and ask for complete accounting services for your branch in Malta instead of opening an accounting department. It is important to know that if a branch is not the appropriate business form for your activities, and if you want to have a high degree of independence, you can choose to open a subsidiary – a legal entity that acts separately from the parent company and can perform other business activities.

If you have a company and need accounting services for your business in Malta, you are invited to discuss all the aspects to one of our dedicated specialists in this field.

Malta’s decision towards EU minimum corporate taxation

As of January 1, 2024, innovative European Union regulations have been implemented, establishing a minimum effective tax rate of 15% for multinational companies operating within EU Member States. Malta has decided not to immediately implement the newly agreed minimum tax rate for companies set by the OECD. Under EU regulations, member states have the option to defer the introduction of the proposed 15% minimum tax for up to six years. These regulations pertain to companies with a global income exceeding €750 million. Approximately 660 multinational corporations with a presence in Malta are anticipated to be affected by this decision, impacting around 20,000 employees. Given the six-year derogation period, Malta finds it economically prudent to postpone the adoption of the new tax regulations for the upcoming year. Despite a standard corporate tax rate of 35% in Malta, the government provides foreign-owned entities with a 6/7ths refund on their tax liabilities within the country.

Facts and figures about companies in Malta

A wide range of motives might stand at the base of opening a company in Malta and among these are: a stable economy, an attractive tax system and the ease of doing business. Also, the lack of formalities for incorporating a company in Malta is another important detail when deciding on opening a firm. Malta is quite an appealing business destination, and if you would like to know more, the following information might interest you:

- there are more than 31,000 companies established in Malta;

- USD 231 billion represents the total FDI flow for 2021 in Malta;

- Malta signed more than 70 double taxation treaties with countries worldwide;

- there are more than 115 ports that connect Maltese companies to the ones from abroad;

- incentives for job creation and reduced taxes for reinvested profits are important incentives for entrepreneurs in Malta.

For more detailed information about the branch and subsidiary in Malta as well as advice for investors, please contact our agents specialized in company formation in Malta.